mygroupinsurance.vivium.be

Communication kit

This page starts by listing documentation for employees.

It then provides some background information for employers: a guide and an interesting FAQ section about the roll-out of this new application.

1 - Information for employees

Video

If it is not possible to play videos on YouTube, you can also download the videos here.

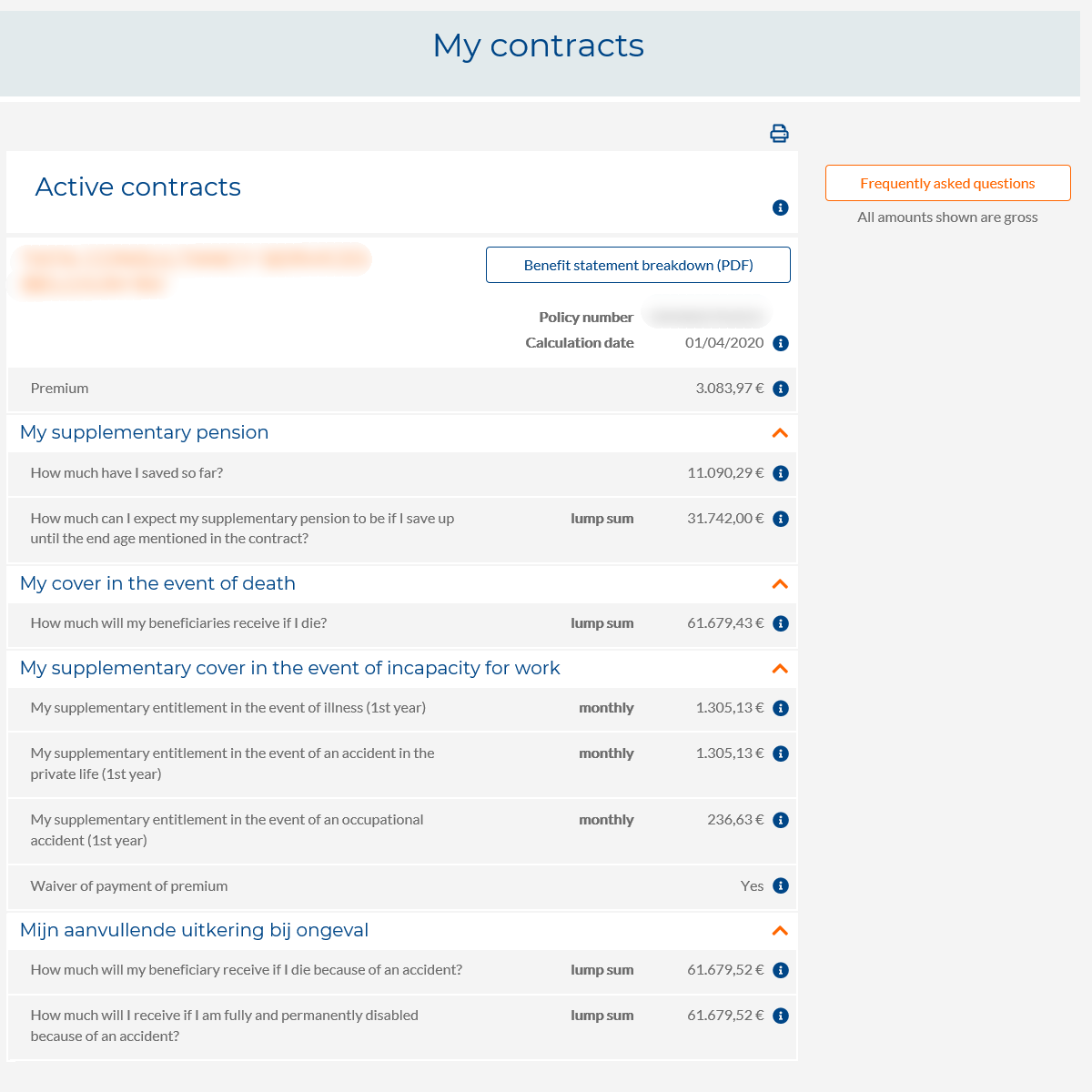

Screenshots of the most important screens

Article about Mygroupinsurance

2 - Information for employers

Email to employees

Guide

Overview of insured parties - download and upload business email addresses

What is 'mygroupinsurance.vivium.be'?

All employees (wage earners) who have or have had Vivium group insurance through their employer can find information about this insurance on mygroupinsurance.vivium.be, in their personal environment:

- An overview of their cover: what does their group insurance cover? (My contracts)

- A 'frequently asked questions' heading for the group insurance.

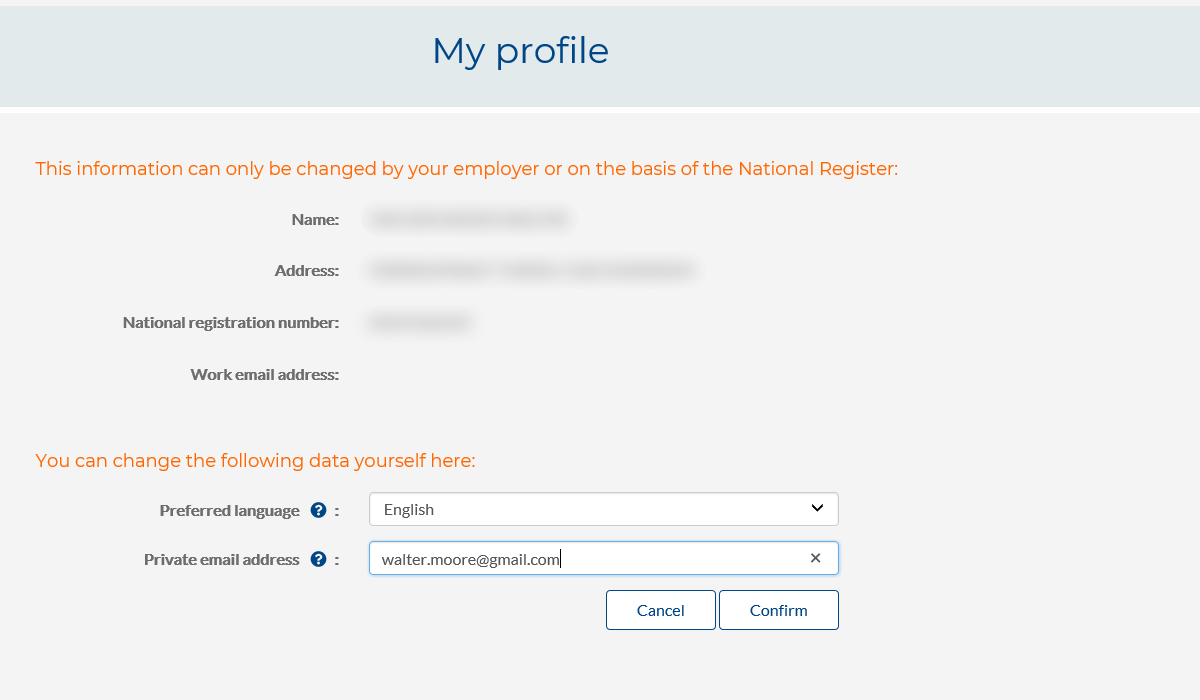

- Their own space 'My profile' with their personal details.

- The official benefit statement: their insured cover.

They won't find information about their personal pension savings or life insurance there.

An employee can have multiple group insurance contracts and each contract may have its own status:

| Active policies: |

Premiums are still being deposited for these contracts. In some exceptional circumstances, no premium has been entered, even though your contract is active. This may be the case when your employment contract has been (temporarily) suspended because of a long-term illness or career break, for example. |

| Passive policies: | Premiums are no longer being paid for these contracts, but there are still reserves (previously saved amount). Cover amounts are still displayed, but no annual premium is filled in for the premium. |

| Terminated policies: | Premiums are no longer being paid for these contracts and there are no remaining reserves. All cover amounts and the premium are set to 'zero'. The reserves for these contracts have either been paid out or transferred to another contract. A contract can be viewed on mygroupinsurance.vivium.be up to six months after its termination. After that time this will no longer be possible. |

For whom is mygroupinsurance.vivium.be intended?

Mygroupinsurance.vivium.be is available to all employees who have or have had group insurance with Vivium through their employer during their employment as a wage earner, provided that there are still reserves remaining (a saved amount).

Has a contract been terminated because its reserves have been paid out or transferred to another contract? Then, the contract can still be viewed on mygroupinsurance.vivium.be up to six months after its termination.

Can my employee find his/her pension savings there too?

No, your employee will only find group insurance policies (contract numbers 530/……) there that he/she has or used to have with Vivium. Pension savings and life insurance are the employee's private affair and are therefore separate from this website.

Can my employee find group insurance policies for the self-employed there too?

No, not normally. These are group insurance policies for wage earners. There are a few exceptions, however. If the contract number starts with 530/…, the policy can generally be found at mygroupinsurance.vivium.be.

Can my employee find information about previous employers there too?

Yes, if the previous employer also had group insurance with Vivium (contract number 530/….. ) and provided that the contract isn't terminated. Six months after all of a contract's reserves have gone, that contract will no longer be available for viewing on mygroupinsurance.vivium.be. Reserves will disappear from a contract if they have been paid out or were transferred to another contract.

Can my employees see more on mygroupinsurance.vivium.be than I can in EB-Connect?

First of all, your employees don't have access to the secure EB-Connect application you use for the daily management of your group insurance.

Besides his/her own details for the group insurance he/she has through you, your employee may also be able to see contracts for previous employer(s) on mygroupinsurance.vivium.be. This only applies if those contracts were also taken out with Vivium and still have reserves. Naturally, you can't see this information in EB-Connect.

The application also provides your employee with a 'My contracts' screen. This screen gives a handy overview of all the cover to which your employee is entitled. This screen does not exist in EB-Connect. EB-Connect is a management application, while mygroupinsurance.vivium.be is intended to provide clear, concise information. So, they have different purposes.

The benefit statements in the pdf which your employee can consult are the same as those you'll find in EB-Connect. Your employee can only see the last (current) benefit statement, while you also have access to the history. Of course, the employee can also save his/her benefit statements locally or print them out, creating his/her own archive.

Can my employee refuse to use mygroupinsurance.vivium.be?

Yes, your employee is not obliged to use mygroupinsurance.vivium.be. All we do is to invite him/her to visit the website by e-mail.

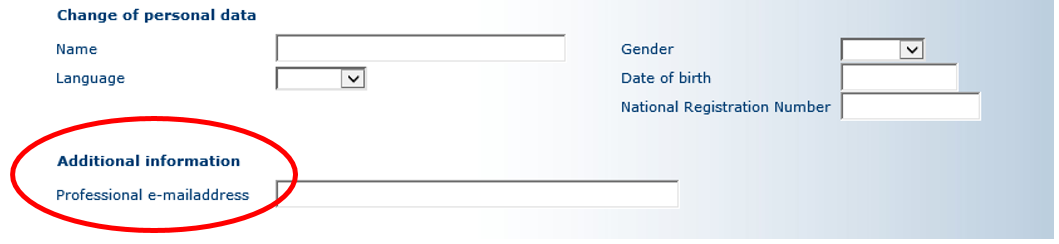

Can my employee change certain things him/herself, so I needn't do as much in EB-Connect?

No, you're responsible for updating the employee's details via EB-Connect. This is to avoid errors and confusion.

One new input field, for your employee's work e-mail address, has been added to EB-Connect.

However, the insured party can change the language of his/her benefit statements on mygroupinsurance.vivium.be and enter and/or change his/her private e-mail address.

An employee says that he/she can't see all of his/her contracts. Is that possible?

This can happen in two cases:

- The contract in question has been terminated, with no reserves related to this contract for at least six months. These have either been transferred to another contract, or paid out.

- No national registration number (or BIS for foreigners) was entered for that contract. This is highly unusual, but possible. Check in EB-Connect whether the national registration number (or BIS number for foreigners) has been entered, and enter it if necessary. The next day, the contract will then be available for the employee concerned.

If I start using mygroupinsurance.vivium.be now, can I stop using it later?

Once you've uploaded the work e-mail addresses in EB-Connect, this launches mygroupinsurance.vivium.be for your employees.

Even if you don't upload the work e-mail addresses, the website is accessible to anyone who knows the web address. Moreover, this address (mygroupinsurance.vivium.be) can be found on all benefit statements.

By combining your uploading of the work e-mail addresses with an internal business communication, you can present this new website to your employees as added value, however.

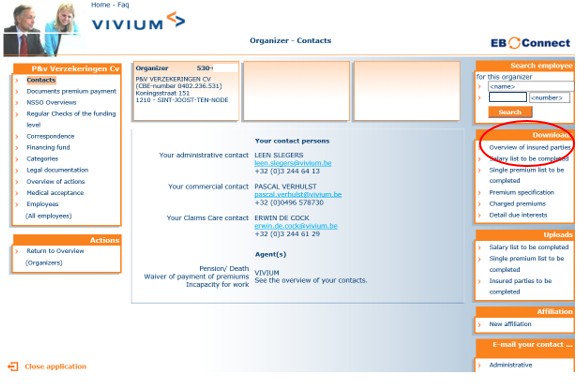

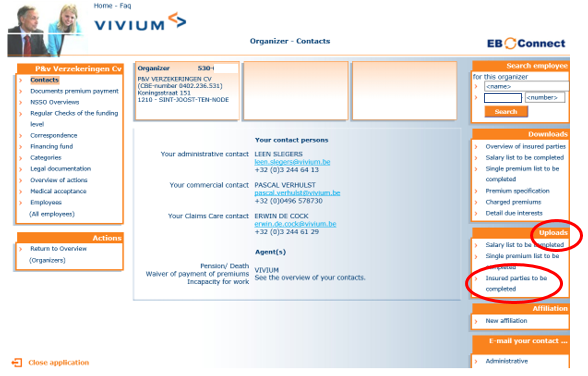

How do I give the insured parties access to mygroupinsurance.vivium.be?

To allow employees access to mygroupinsurance.vivium.be, Vivium requires their work e-mail addresses.

You can supply Vivium with these work addresses by requesting an Excel file for the insured parties in EB-Connect (Downloads – 'Overview of insured parties').

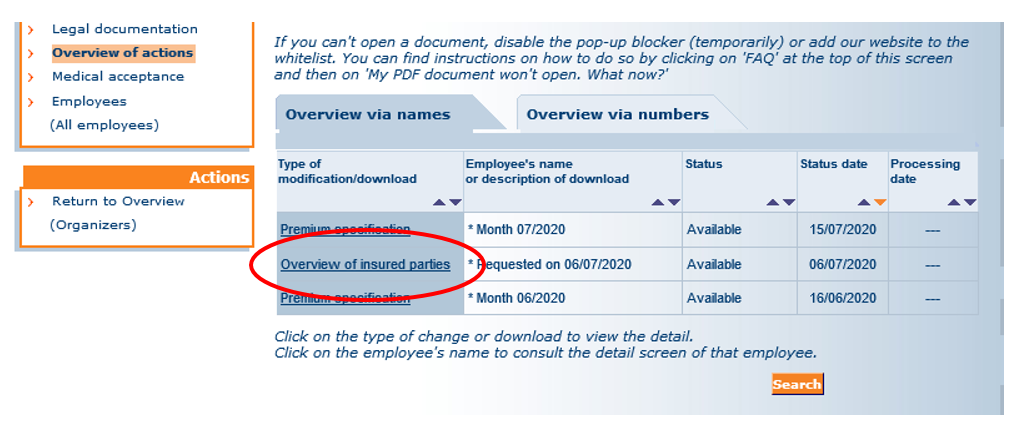

Step 1: take a download ‘Overview of the insured parties'.

Step 2 (maximum 1 hour later) : pick up the download and fill in the professional e-mail addresses.

You go to 'Overview Actions' to call up the Excel file, enter the work e-mail addresses in the green column "professional e-mail addresses" and save the Excel file.

Finally, you use 'Uploads' to automatically upload the Excel file to our files.

The next day, the insured parties will receive an e-mail invitation to log in to mygroupinsurance.vivium.be. They can view their latest status and benefit statement at this time.

When the insured party logs in, we also request his/her private e-mail address. This enables us to keep in contact with him/her.

If your employees don't have a work e-mail address, be sure to ask them to fill in their private e-mail address the first time they visit the website.

How many e-mails will my employee receive if he/she uses the new mygroupinsurance.vivium.be website?

When an e-mail address is entered or changed, your employee will receive a confirmation e-mail to that e-mail address.

When a new benefit statement is issued, your employee will receive an e-mail to each known e-mail address. That way he/she knows that an update has taken place.

Will I need to re-upload e-mail addresses each year from now on?

No, you only have to upload all work e-mail addresses once, when launching mygroupinsurance.vivium.be.

When a new employee is added to EB-Connect, we'll ask you to provide the employee's work e-mail address. The employee enters his/her private e-mail address him/herself via mygroupinsurance.vivium.be.

Only in exceptional cases of changes affecting all work e-mail addresses will you need to re-upload these (if a company name change impacts the domain name, for example).

Is there a guide on uploading e-mail addresses in EB-Connect?

Yes, in the secure EB-Connect application under 'FAQ' (at the top of the screen) you'll find a guide with all of the steps to download, fill in and re-upload an overview of insured parties.

Will Vivium continue to send paper benefit statements?

No, Vivium has replaced the paper benefit statement by the website Mygroupinsurance.

If any employee exceptionally wishes to have a paper version of a benefit statement, you can always print it from EB-Connect.

Will my employees be informed when new benefit statements are available?

Your employees will receive an email with each update via the email addresses provided to us until they leave the company. Your employees should also add their private email addresses to their profiles so we can also notify them of any updates after they leave the company.

Would you like to check which email addresses Vivium has on file? They can be downloaded via 'Overview of insured parties' in EB-Connect. If necessary, you can update the details and upload them again.

How do I upload my employees' e-mail addresses?

By downloading and uploading an Excel file for the insured parties in the secure EB-Connect application.

You'll find a detailed guide in EB-Connect under 'FAQ' (at the top of each screen).

Not all of my employees have a work e-mail address. What do I do?

In that case, you can -if you have it at your disposal- fill in the private email address. If not, don’t fill in anything. You then have to communicate yourself the address of mygroupinsurance.vivium.be to your employee. He/she will connect and fill in his/her private e-mail address.

You also can add or modify email addresses later on via ‘modification personal data’ or through a new download.

Vivium asks for private e-mail addresses too. Why?

When an employee logs into mygroupinsurance.vivium.be for the first time, we ask him/her for his/her private e-mail address. He/she can also decide to enter this later. Afterwards, he/she can change this at any time via 'My profile' in mygroupinsurance.vivium.be.

We offer this option because some employees prefer not to check the status of their group insurance at work. At the same time, we want to keep in contact with the insured parties, even if their employment with you has ended (left the company/retired).

We'll shortly be adding a 'Payments' module to mygroupinsurance.vivium.be. Via this module, we'll handle the payment of the supplementary pension capital entirely by digital means. This will offer employees advantages in terms of speed, transparency, document archiving and fraud prevention.

Some employees don't want to receive e-mails at their private e-mail address. What should I do?

Try to convince the employees concerned that it's important for Vivium to stay in touch with them after their active employment ends; for the payment of the retirement lump sum, for instance.

This isn't compulsory.

What if an employee doesn't have a private e-mail address?

No problem. If he/she has a work e-mail address, he/she will be informed of his/her new benefit statement by this route.

What will change in EB-Connect?

The insured party's details will be amended to include a field for the work e-mail address.

Furthermore, the work e-mail address will be added to the 'Overview of insured parties' download, which will also show you whether we have access to an insured party's private e-mail address.

Do employees have to register like for EB-Connect?

No, no registration or user management is required for mygroupinsurance.vivium.be.

You needn't concern yourself as the employer.

How do my employees get access to the website?

This takes place via the same software as for Tax-on-web or Mypension. The administration is handled by the FAS (Federal Authentication Service) government service. Anyone who logs in passes through the FAS checks to Vivium's website.

What if logging in is unsuccessful?

The FAS offers several, highly secure ways to log in, together with the necessary support. You'll find more information on the actual log-in page.

Can a foreign employee log in to mygroupinsurance.vivium.be?

- All employees with a Belgian identity card, residence permit or itsme access can log in to mygroupinsurance.vivium.be.

You can also log in with the BIS number on your residence permit. Please note that as soon as you receive your final national registration number, you do have to ask your employer's HR department to update your group insurance with this new national registration number. Otherwise, you will no longer be able to log in.

How can you tell the difference between a national registration number and BIS number?

- The national registration number starts with your date of birth in reverse order (for example 910815 xxx xx for a person who was born on 15 August 1991).

- The BIS number starts with your date of birth in reverse order, but the birth month is incremented by 20 or 40 (for example 914815 xxx xx for a person who was born on 15 August 1991).

- Foreign employees without a residence permit, eID card or itsme access need to register before they can log in.

To register, you have to make an appointment with the registry office of one of the participating local councils in Belgium. You need to take your passport to your appointment. A list of the participating local councils is shown here.

In the meantime, you can request a copy of your annual benefit statement from your employer's HR department.

Where can my employee find answers to specific questions about mygroupinsurance.vivium.be?

The website mygroupinsurance.vivium.be makes group insurance more accessible to your employees. In this way, the website supports your efforts to provide non-statutory benefits.

Most questions will be covered by the 'tool tips' (‘i’ about all technical terms) and FAQs.

If these prove insufficient, you yourself are best placed to answer more specific questions. Naturally, you can always call your personal manager at Vivium or your account manager. He/she will be pleased to assist you.